The Trend is Your Friend, Until it Bends

Trends appear on all time frames. The Trend Is Your Friend, Until it Bends…. what does this mean?

Trends appear on monthly, weekly, and daily charts for long-term trading. They appear on H4 charts all the way down to H1 charts for day trading and on 30 min charts down to 1 – 5 minute charts for scalping.

One of the greatest financial benefits of learning how to trade currencies is learning the skill of spotting a trend that can last several hours for scalping, several days for day trading, and several months, for long-term trading that may create enormous financial returns for the skilled and educated trader.

As you learn to trade the Forex, you need to possess three very simple yet critical trading keys:

1. Learning how to determine market direction on any time frame

2. Utilizing a simple entry strategy that works

3. Using a tested exit strategy that consistently works (this is how you get paid)

The Forex market is open 24 hours a day, 5 ½ days a week. At any time during market hours, you can turn on your Internet-connected computer and sit down to trade.

While setting aside the time to trade is important, the most important step of successful currency trading is turning on your charting analysis software and determining market direction on any time frame.

The fact of the matter is, if you want to make money through trading, you will have to take a bullish or bearish position. You must choose one or the other. You cannot hold both opposing positions simultaneously in one trade. You simply cannot make money taking a bullish and bearish position at the same time. You would be in a net zero position, making and losing the same amount of money with every pip movement. For this reason, you must choose a side and luckily, due to visible patterns in the market, you can make an educated decision about which side you would like to be on at that trading moment.

People trade according to their personality. Aggressive people love to scalp, while passive people love long-term trading.

Figuring out your trading style is very important to do before you begin to trade.

However, whether you are a passive trader or an aggressive trader, you need to be able to determine market direction before you trade. You need to learn how to find the current major trend before you enter the market because you need to trade in the direction of the major trend at all times. Do not fight the major trend. Fighting a trend is like trying to swim upstream in violent, forceful rapids. It doesn’t work!

“Traders can make many mistakes. The biggest mistake is trading in the wrong direction! ”

One of the best ways to determine market direction is to use charting software like the MT4 charting software. If you are an active trader and are using charting software that does not have a moving trendline indicator, you will need to learn the skill of drawing ‘correct’ trendlines.

I use the term ‘correct’ because many traders think they are drawing their trendlines correctly only to find out later that the trendlines they used to place their trades were detrimentally incorrect. An incorrectly drawn trendline could mean the difference between making money on a trade and losing money on a trade. Drawing trendlines is a skill that can be taught and most successful traders turn this skill into an art.

Successful traders are constantly aware of market movements and they monitor all trend lines on all time frames. Why? Because the trend in one time frame is not your friend in another….”the trend is your friend”, is a very relative statement and needs to be qualified by looking at all the time frames… because the movement on smaller time frames will always respond to the trendlines on larger time frames.

This means, if the market is retracing back down toward an upward trendline on a daily chart, that retracement on the daily chart may be a 200-pip move. A 200-pip retracement from a daily chart will be a downtrend movement on a 60-minute chart. If you only look at the 60-minute chart to do your analysis, you will be in a strong downtrend and your bias will be bearish. You will probably enter the market bearish.

However, the way Murphy’s Law works, you will be entering at the end of that 60-minute trend because as soon as the market from the daily chart hits its trendline, the 60- minute chart will reverse and begin to rally and you will be sitting there scratching your head while you lose money wondering what happened.

So, the trend is your friend, but only if you are trading in the direction of the higher slower time frame… anything else in a faster time frame is just a retracement and not the true trend.

Yes, you can trade the retracements which is a shorter play and still make money… it’s actually one of my favorite ways to trade, but you have to know what you’re doing… you need to be able to see the faster trends in relationship to the slower trends… you need to recognize easily that the retracement is a shorter trend in the overall longer main trend.

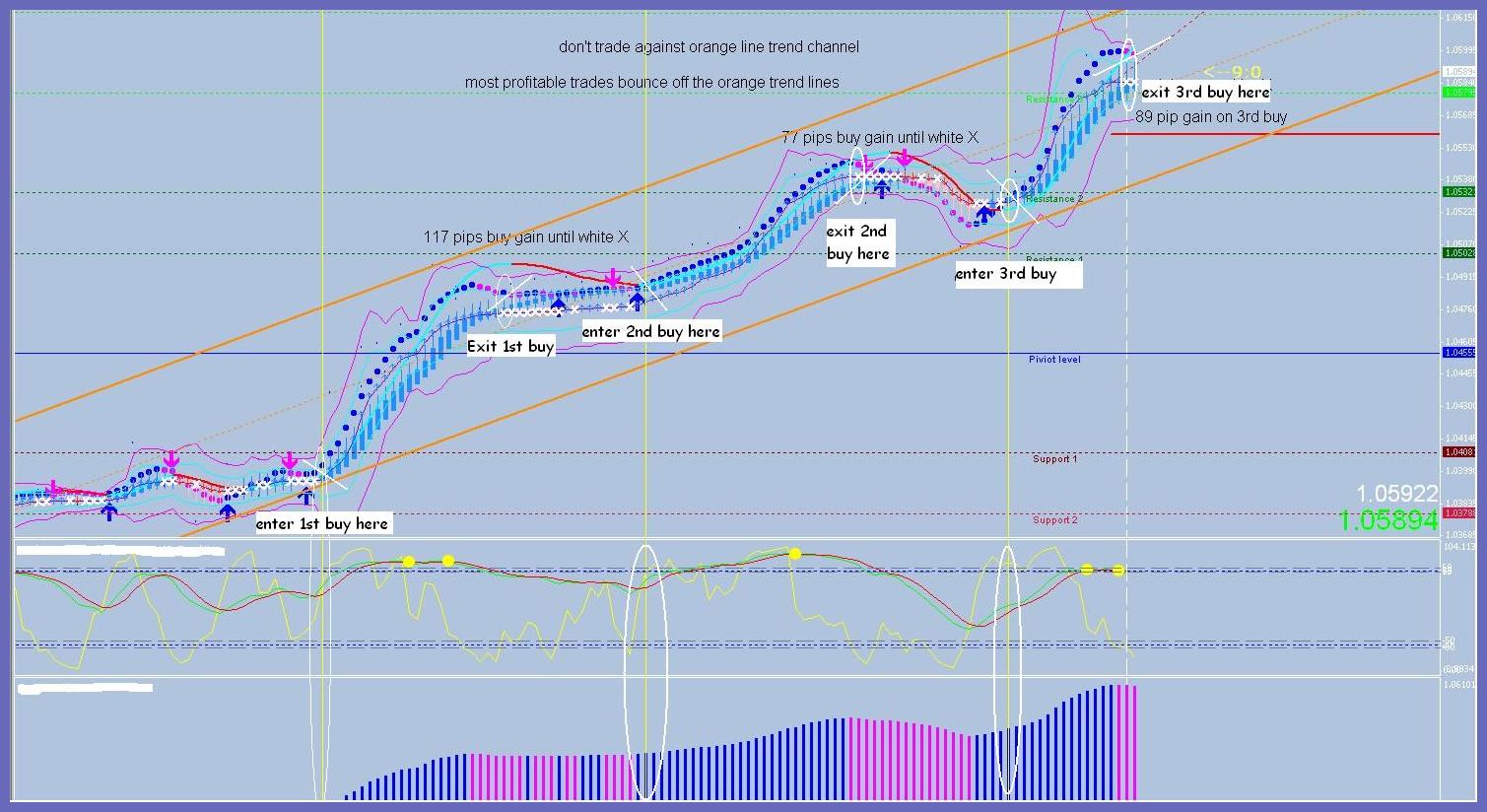

Here’s a chart showing the trend channel using my Color Coded Trend Trading System:

If you are a beginner forex trader, my Color Coded Trend Trading System has an indicator that automatically draws and re-draws the trend channels for you. You’ll be able to easily see the shorter faster lesser trends within the longer slower main trend and if you want to trade the retracements, at least you’ll know what you are doing because you can see all the trends at the same time.

I teach you how to sell off the resistance trendline and buy from the support trendline. You can scalp, day trade or swing trade using this system. Using this trading system, the trend is your friend, as easy as it can get!

Please CLICK HERE to visit the website to learn more.

Happy Trading from Cynthia of Day Trade Forex!

“Trading from the beaches of Mexico! You can too!”